Our comprehensive Know Your Customer (KYC) procedure exceeds industry standards, and creates multiple layers of verification to protect you from bad actors.

Our comprehensive Know Your Customer (KYC) procedure exceeds industry standards, and creates multiple layers of verification to protect you from bad actors.

Every login and transaction requires biometric verification, adding an extra layer of security that can’t be replicated, stolen, or forgotten.

Sliq pay Secure

Sliq pay SecureOur sophisticated AI algorithms continuously monitor transactions to detect suspicious activities, and ensure compliance with anti-money laundering regulations.

Sliq pay Secure

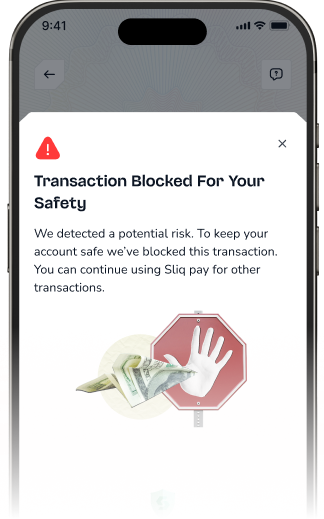

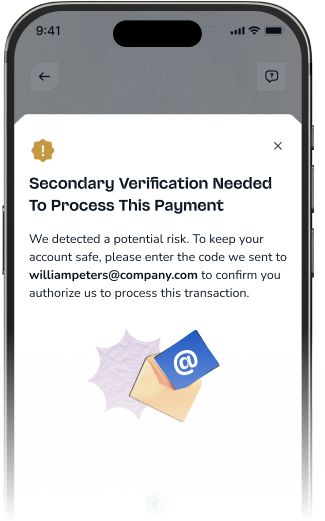

Sliq pay SecureOur fraud-detection engines proactively flag suspicious activity and send instant alerts for secondary verification, ensuring only you authorize payments

Every data, every payment, every connection is encrypted and verified across our global network. Your funds stay secure, your privacy stays intact.

Our team undergoes rigorous ongoing training to protect your data at all times. We enforce strict access controls and adhere to industry-leading data protection standards.

Powered by AI and real-time analytics, our experts detect and neutralise potential fraud in milliseconds, before it happens. We prioritise speed, precision, and accuracy.

You can send Indian rupee (INR) to someone’s bank account in India, including NRE and NRO accounts, or UPI.